Starting 1 May 2020 eligible. Ad Discover a variety of ESG-focused ETFs with strategies that may align with your values.

As such Public Mutual is prohibited from opening accounts for EPF members andor receiving credit transfers from members commencing from yesterday said.

. EPF Members Investment Scheme. 1 Foreign exposure is up to 25 of the funds NAV in overseas market. KUALA LUMPUR June 23.

Register for PRS account opening and contribute into PRS funds. EPF Investments is the direct real estate investment and development arm of the Group. The stimulus package for EPF Members Investment Scheme EPF-MIS at the sales charge of 15 will be ended on 30th April 2021 and reverting back to 3 with effect from 1st May 2021 onwards.

Employees Provident Fund EPF members investing under Members Investment Scheme EPF MIS will be entitled to a reduction of upfront fees charged by Fund Management Institutions FMIs for a period of 12 months ending 30 April 2021 enabling them to diversify their retirement portfolio at a lower cost. Brought to you by Phillip. Our 3-Minute Confident Retirement check can help you start finding the answers.

Ad Understand The Responsible Investing Landscape. There are fees and charges incurred when investing in the above-mentioned funds. The Employees Provident Fund EPF has connected five additional platforms from six Fund Management Institutions FMIs to i-Invest the funds self-service online investment facility.

Wide Range of Fund Choices. The volatility banding for the Very Low Low Moderate High and Very High VCs as at 31 December 2021 are 0000 VF 4190 4190. Gain exposure to dynamic sectors while investing in a brighter tomorrow.

There is equity exposure in EPF which makes it slightly riskier than PPF. After completion of this duration you can extend it in 5-year blocks. 2 Foreign exposure is up to 30 of the funds NAV in overseas market.

Ad Gauge your retirement readiness and see where you stand today. Public Provident Fund is a long term investment tool run by the government which offers fixed and safe returns to their investors. KUALA LUMPUR 23 June 2020.

Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. Effective 1 July 2019. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia.

You can also invest in a range of Shariah-compliant funds through Principal and EPF i-Invest. Mutual funds are managed by fund managers who offers their investor to reap maximum benefits by investing in instruments according to the mutual fund schemes. Under Phillip Mutual Berhad Platform we distribute more than 118 EPF funds from over 14 EPF Providers.

Transact anytime and anywhere via PMO. However investment returns with EPF i-Invest are not guaranteed so youll also need to do your research to select performing funds. Initial investment as low as RM100.

Minimum 5000 Units at any time accumulate from EPF Cash investment accounts Up to 100000 Units The total sum cover is equal to the number of units held in the ratio of RM1 for every. 4 Foreign exposure is up to 98 of the funds NAV in overseas market. No changes in terms conditions for current rules of EPF unit trust investment under this new amendment.

Invest in our e-Series of Funds with a minimum initial. We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. The platforms are from Affin Hwang Asset Management Berhad Kenanga Investors Berhad RHB Asset Management Sdn Bhd sharing its.

Institutions - EPF AM works alongside major funds and institutions to target larger lot sizes at discounts to market value capitalising on our asset management expertise in the retail and leisure sectors. 3 Foreign exposure is up to 60 of the funds NAV in overseas market. The nominee in the EPF record if any or beneficiary of the deceased EPF Members estate has to first apply for full withdrawal and close the EPF account of the deceased.

Principal Asset Management Bhd. Use the Fund Selector under Fund Tools to analyse and compare information on any approved unit trust funds. Public Islamic Infrastructure Bond Fund Up to 25 The list of EPF-qualied funds is as at 1 April 2022 and is subject to annual review by KWSP.

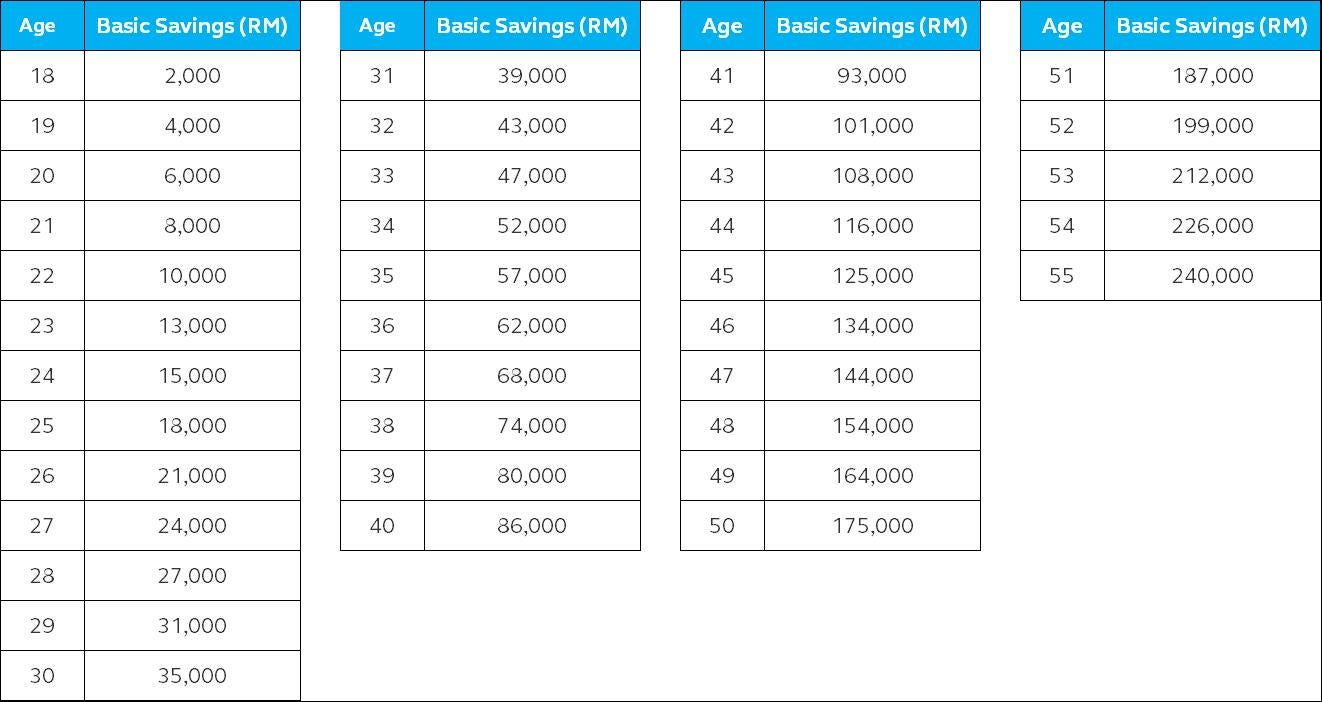

Let say 3 sales charge for PB Mutual and EPF dividend is giving 5 how much does PB Mutual need to perform on par with EPF return. In a statement today the EPF said the platforms are from. Withdrawal of EPF Acccount 1 for unit trust investment can be done on a quarterly basis not more than 20 of savings in excess of the Basic Savings amount in Account 1.

It also helps you select the. Contact their servicing unit trust consultant. The investments we create.

The Employees Provident Fund EPF has connected five additional platforms from six fund management institutions FMIs to the EPFs self-service online investment facility i-Invest to enhance flexibility of online transactions for the EPFs Members Investment Scheme MIS. Since 1st January 2017 members can invest not more than 30 of their credit in excess of Basic Savings in Account 1 in the Fund. EPF is a compulsory scheme for workers under the EPF Act whereas PPF is voluntary and is available to all Indian citizens.

Invest into new and existing funds register for DDA Regular Investment Authorisation RIA and Regular Withdrawal Plan RWP as well as perform requests for redemption and switching. Equity mixed asset fixed income bondsukuk money market funds are available in conventional Shariah-compliant series. The investment duration for a Public Provident Fund or PPF is 15 years.

Combining our own equity with a pre-approved line of finance EPF Investments targets acquisitions which can maximise returns within a 1-5 year profile. It typically focusses on leisure retail and mixed-use properties with opportunities to add value. Benefits of Investing in e-Series of Funds.

Thereafter EPF will issue a release control letter to Public Mutual to change the fund accounts with Public Mutual from EPF to cash. 22 rows No upfront fees will be imposed by FMI for investments transacted through i-Invest via EPF i-Akaun while for investments made through agents the upfront fee will be reduced from a maximum of 3 to a maximum of 15. Developers - EPF AM works with major developers on site-assembly strategy and negotiations.

MIDF Amanah Asset Management Berhad. EPF and PPF investments are safe due to their statutory backing. For EPF and VPF the account remains active until the time you retire or resign.

How To Get Started With Responsible Investing. PB Mutual invest RM1k after sales charge RM970. Upon receipt of the certified true copy of Letter of Administration or Grant of.

VF is subject to monthly revision and VC is revised every six months or other interval as advised by FIMM. Public Mutual Bhd 8th Floor Menara Public Bank 2 No 78 Jalan Raja Chulan 50200 Kuala Lumpur. What can Public Mutual Online do for you.

Go to the nearest Public Bank branch. Public Mutual Bhds services as an approved fund management institution under the Employees Provident Fund EPF Members Savings Investment Withdrawal has been suspended effective Oct 29. Investments under the MIS are on a voluntary basis and provide.

Both are exempt to tax subject to certain mandates. In order to match with EPF return u need at least 82 return. The EPFO Employees Provident Fund Organization revises their interest rate every year.

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

7 Top Performing Epf Approved Equity Unit Trusts You Should Not Miss

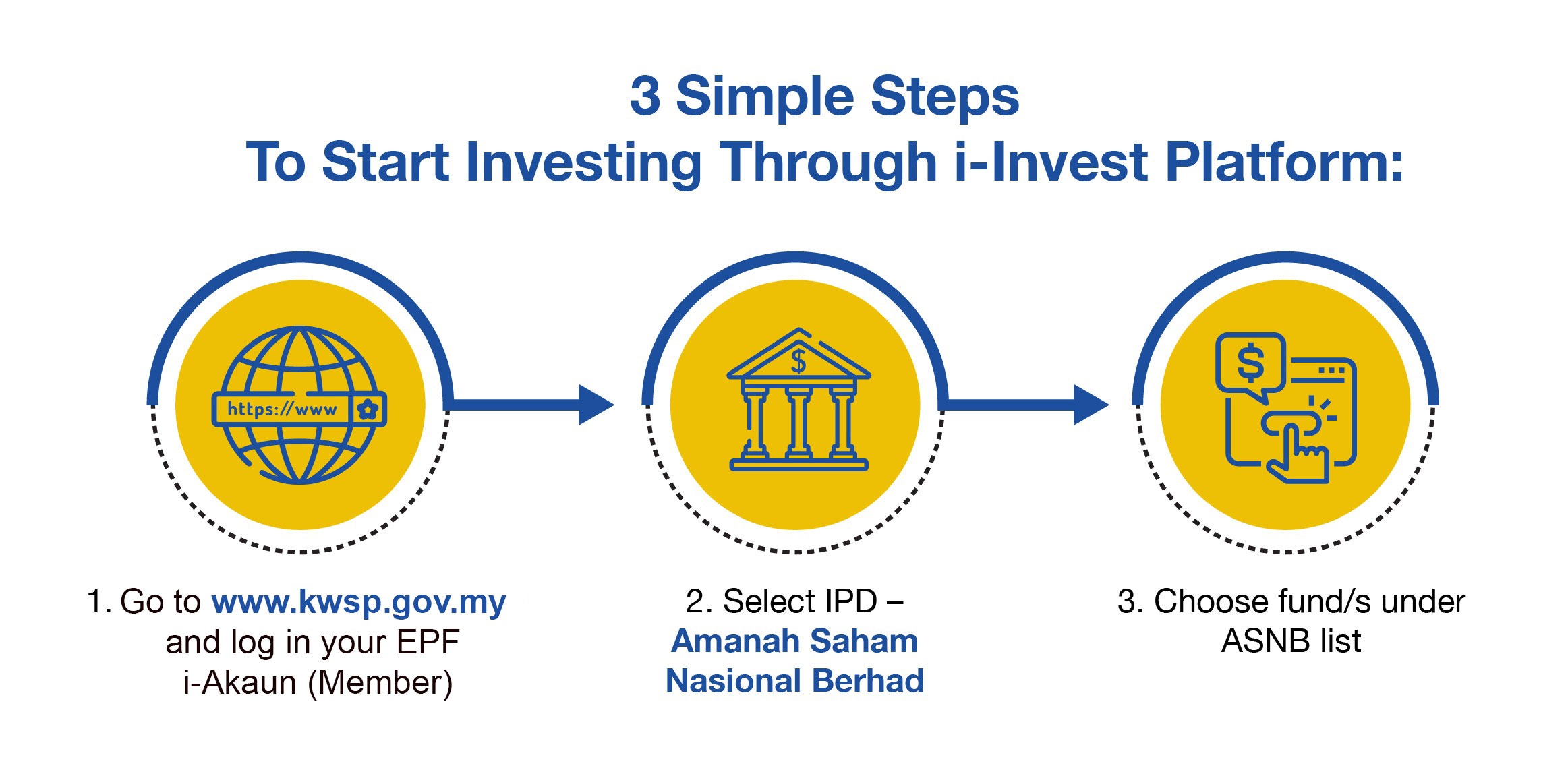

Epf I Invest Features You May Not Know About

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

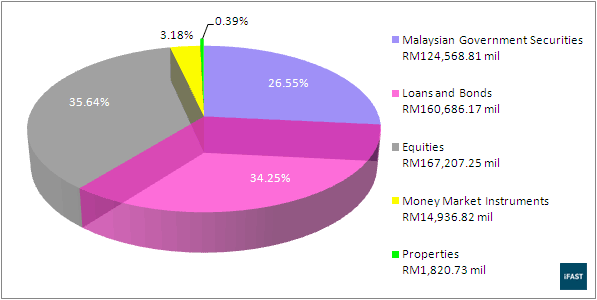

1 Statistical Summary Of Epf Investment Asset Allocations Download Table

Grow Your Wealth The Islamic Way

Kwsp Epf Investment Ijan Unit Trust

7 Top Performing Epf Approved Equity Unit Trusts You Should Not Miss

Epf Withdrawal For Unit Trust Investment 13 Other Ways

Amanah Saham Nasional Berhad Asnb I Invest

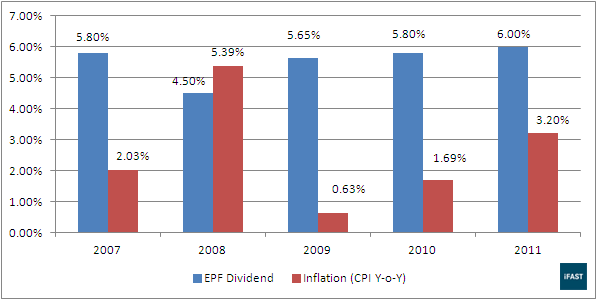

Epf Investment Portfolio Vs Unit Trust Portfolio Which One Is Better I3investor

Uneedtrust Where Trust Is Mutual

Grow Your Wealth With Unit Trust

Epf Investment Portfolio Vs Unit Trust Portfolio Which One Is Better I3investor

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf Investment Portfolio Vs Unit Trust Portfolio Which One Is Better I3investor